3d printing goes on the industrial manufacturing and automation of that process which is one of my three big investing ideas so that’s why I think this is a really interesting space and anything that can make manufacturing automated , more efficient , more reliance or precise I think is a great space to look for investments.

What is 3D printing Technology ?

3d printing is by no means of brand-new technology. it was around already back in the 70s but it really really didn’t do much until the 2010. Today is used in complex manufacturing of medical devices , weapons , computers and aerospace parts.

3d printing is a pretty complicated stuff and I’m not going to go into the details of the actual process but basically the definition is ” printing process that builds a three-dimensional objects from a computer added design” .

which is successively adding materials layer by layer also called additive manufacturing. it’s basically computers making stuff from and with stuff. so a computer either adds materials or extracts materials and is at the end left with an object’s.

Some of the Big companies using 3D printing already like :

- General Electric uses it for jet Jets engine fuel nozzles

- Boeing for a wide range of jet parts it even costs us a complete cabin once so the shell of the plane

- Ford for engine covers on Ford Mustangs

- Nike on shoes placing and cleats

- Hasbro for certain toys and toy pants

- Hershey’s 3d prints chocolates

There are many use cases for 3d printing and these are just some of the big commercial projects we’ve seen so far but I’m sure this is only the beginning. The development of 3d printing devices and software also might sort of follow Moore’s law and will become much faster and more efficient , as the parts used in 3d printing like laces and sensors and computers becomes more powerful.

3D printing market

we will see the power and capability of the printers go up and the price will go down. Lowering of prices will accelerate the development so you could see a development, just like we’ve seen computer chips that just continuously getting faster and cheaper and that spurs on even more developments now.

companies we are gonna cover are all publicly traded companies. you can invest in them but they are small and they’re in a very young small and volatile space. so there’s gonna be some atrocious numbers from some of them so don’t be expecting Apple , Johnson & Johnson kind of balance sheets. Take everything with a grain of salt here and you got to look for the positives.

Stocks to invest for 3D printing market

There’s no big well-established player here these companies are all very small so the risky but the potential upside is strong .

No. 1 Stock to invest for 3D printing is proto labs

Stock Symbol : $PRLB

market cap 2.2 billion

Revenue 488 Million in year 2021.

it’s a 20 year in business and it’s pretty much the leader in 3d printing. As most of the other companies it specializes in medical devices, aerospace and automotive those are really the industries they hone in on. it specializes in sheet metal fabrication , injection molding and CNC machining and 3d printing.

so these companies are not just doing 3d printing they do all sorts of or autonomy of manufacturing. Now over to the numbers.

As you can see , it is underperformed the S&P 500 which is an index by 75% over the last five years.

Proto Labs Financial information :

| Financial Indicator | Value |

| P/E | 27.83 |

| Forward P/E | 20.65 |

| Prince-to-Book | 0.81 |

| Income | 23.50M |

| Sales | 496.40M |

No.2 Stock is 3d systems.

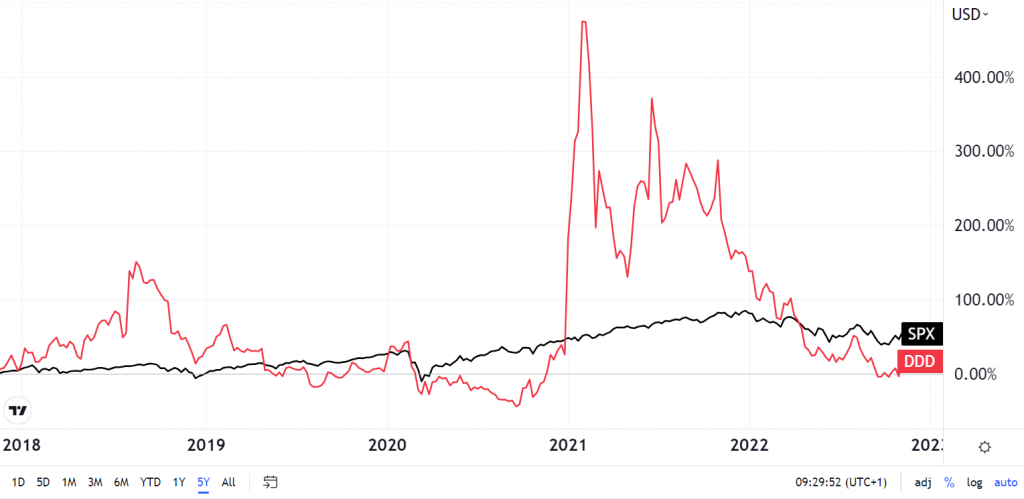

Stock Ticker symbol is $DDD

Market cap $950 million

Revenue is $156 Million.

This is the world’s oldest 3d printing company and it sells the actual printers and the software needed to operate them. This is pretty much a pure play for 3d printing and it’s sort of owning pics instead of the gold mines sort of play.

it has underperformed the S&P 500 by 3% over the last five years. As you can see this stock is on roller coaster ride .At some point outperforming S&P500 as much as 400%.

3D Systems Financial information :

| Financial Indicator | Value |

| P/E | – |

| Forward P/E | – |

| Prince-to-Book | 1.70 |

| Income | -103 Million |

| Sales | 556.02 Million |

No.3 Stock in 3D printing business is stratasys

You might have heard of from catherine de woods , over at ARK invests. because this is her favorite Stock.

ticker symbol $SSYS

Market cap 875 Million US dollar

Revenue 636 Million USD.

This is a 32-year veteran which specializes in additive manufacturing and it makes the actual princes for 3d printing. it specializes in health care, automotive and education. of all things they sell the actual printers as well.

and they’ve underperformed the S&P 500 by 25% percent. Once again if there is any stock which is in ARK investment’s radar you expect it to be volatile .As you can see this stock has quite a bit of swing compare to S&P500 in recent years.

Specially in 2022 when the money is not cheap and rising interest rates from FED makes it difficult for Innovative companies which are cash hungry.

Stratasys Financial information :

| Financial Indicator | Value |

| P/E | – |

| Forward P/E | 71.91 |

| Prince-to-Book | 0.90 |

| Income | -68.20 Million |

| Sales | 656.02 Million |

No.4 Stock for investing into 3D printing business is Materialise NV

Is actually a Belgian company but it trades on the Nasdaq

Stock Ticker $MTLS

Market cap 992 Million US dollar

Revenue 211 Million US dollar

these guys specializes in helping companies improve their 3d printing process. They provide software and a device so this is a bit of a different play and it’s an international company which makes it a bit more interesting.

It underperform the S&P 500 by as much as 8% . IT had last five years of 88% revenue growth. The company has done absolutely fantastic. But stock has taken major hit in recent 2022 sell offs.

Materialise NV Financial information :

| Financial Indicator | Value |

| P/E | 78.25 |

| Forward P/E | 66.62 |

| Prince-to-Book | 2.38 |

| Income | 7.40 Million |

| Sales | 234.09 Million |

No.4 for investing into 3D printing software business is Autodesk

This is the company that provides software for the architects, designers and engineers that actually uses 3d printing to print stuff . if something is 3d printed they have to be used designed by 3d software from Autodesk.

This is obviously a great company and it has outperformed the S&P 500 by 8%. This is a fantastic company with solid numbers. it’s software as a service and it is also included in our kin vests 3d printing and industrial innovation ETF. This is sort of a no-brainer but the numbers are not that impressive. I would definitely like to see a software company post a lot better numbers and be a bit more financially sound because it’s quite easy to make money with proprietary software and with high margins it should be able to generate more cash.

Autodesk Financial information :

| Financial Indicator | Value |

| P/E | 82.23 |

| Forward P/E | 27.98 |

| Prince-to-Book | 61.69 |

| Income | 557.40 Million |

| Sales | 4.7 Billion |

Out Take on which stock to invest into 3D printing technology :

I would probably go with a proto labs or Autodesk.

ETFs to consider in 3D printing investment:

ETFs are just like stock funds but they’re traded like a regular stocks and the only company offering 3d printing ETFs is old favorite Ark investing by Cathie woods .Which is not so much favorite in 2022 due to its bad management and returns in 2022.

No.1 Ark invests 3d printing ETF

The 3D Printing ETF ( PRNT) promises to provide investment results that closely correspond to the performance of the Total 3D-Printing Index. This is ETF is designed to track the price movements of stocks of top companies involved in the 3D-printing technology and business.

Top holdings in this ETFs are : BICO , FARO TECHNOLOGIES INC , ANSYS INC and PTC INC

No.2 ARK’s industrial innovation ETF

ARKQ is an actively managed Exchange Traded Fund (ETF) that seeks long-term growth of capital by investing in domestic and foreign stocks of companies into autonomous technology and robotics companies.

Top holdings in this ETFs are : TESLA INC, TERADYNE INC , AEROVIRONMENT INC and3D SYSTEMS CORP the name we just covered in best stocks of 3D printing business.

If you are looking for investment don’t just directly put your hard earn money into 3D printer making companies. 3d printer can’t stand alone that’s why I personally would go with something like some ETF or Autodesk which is sort of like investing in the backbone of 3d printing not the printers.

Do follow us on Twitter and check out chart section for more details.