If you’ve ever been in debt you know it can feel like running on a treadmill. every month you pay a little to this loan a little to that card and eventually you feel like you’ve gotten well nowhere. But it doesn’t have to be that way not if you have a debt repayment strategy in place. Trust me , you will need it if you are in low income range to pay off your debt fast.

Strategy that helps you map out a plan that’s realistic enough to follow stick to the plan and before you know it you’ll be moving in the right direction, chipping away at your debt.

for this discussion let’s focus on high interest credit card debt so let’s get started.

How to payoff High Interest Credit card debt

while there are many ways you can attack your debt. There are two schools of thought in particular that we’ll discuss here the

First is commonly referred to as the snowball method it’s when you pay off your debts by balance the lowest first.

Another tried-and-true method is to pay your debts according to their interest rates starting with the highest rates first for this discussion let’s call it the high rate method.

so how do these strategies actually work:

Strategy 1 : Snowball method to payoff your debt

let’s start with the snowball method first. Make a list of all of your credit card balances from lowest amount to highest. if two balances are similar prioritize the card with the higher interest rate. when you pay your monthly bills make the minimum payment due for all of your debts then take any additional money you have available and put it toward the debt with the smallest balance.

Do this each month until you paid off your smallest debt. When you pay it off don’t use that account again until your debt is cleared up. Whether you hide the card in a drawer , freeze the card in a block of ice or close the account the point is to stop increasing your debt.

The next step is to take the money you are paying toward that bill and apply it to the next smallest balance on your list and as you continue moving down your list. The amount you’re able to pay to each balance continues to grow and grow creating wait for it a snowball effect. you might be amazed how quickly that can happen.

Now let’s talk about the high rate method.

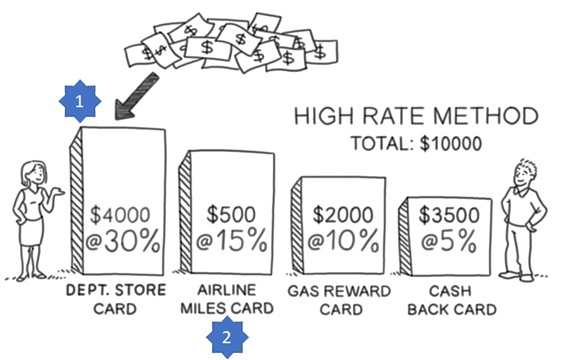

Strategy 2 : High Rate method to payoff your debt

Again make a list of all your debts but instead arrange them according to their interest rates. With the highest interest rate first. Using this method you’ll also pay the minimum amount due across the board then you’d focus on sending as much as you can afford to the account with the highest interest rate.

keep doing that until it’s paid off. Once your balance is zero concentrate on the card with the next highest rate on your list and so on.

Either of these methods can be a great way to get yourself out of debt and while both methods have their supporters it’s really up to you to decide what works best.

Which Method is best for paying off your debt ?

Supporters of the snowball method say that you’ll feel a boost each time you pay off an account and those small victories keep you motivated to reach your goal. In fact a study published in the Journal of marketing research says that the act of closing accounts after they’re paid off regardless of size is a better predictor of whether you’ll get out of debt in the long run.

On the other hand supporters of the high rate method will tell you that over time you’ll save much more money and get out of debt sooner by paying off your higher interest rate debts first.

What’s right for you well it’s a personal choice but if you want to get out of debt paying as little as possible it’s probably a severe decision to use the high rate method. Because you’ll get rid of your most expensive debt sooner and pay less over the long-run but if you’re the type of person who has trouble sticking to a plan or if you need constant motivation then the snowball method might be a better fit for you.

Important advice on debt payoff

Oh one more thing there are some instances where you might not want to go it alone like let’s say you’re unable to make your minimum payment or you’re having a difficult time making ends meet. otherwise if that’s the situation you’re in you might benefit from talking to a certified financial professional. But it’s important that you look for one who works for an accredited nonprofit consumer credit counseling agency and is a member of the National Foundation for credit counseling.

Whatever you choose to do the most important thing is that you’ve decided to get yourself out of debt in the first place and with some determination dedication and a plan you can get out of debt once and for all and that’s something that you really can’t put a price on.

Do check out our chart section for more interesting charts which can help you make better investment decision.

Also don’t forget to follow us on twitter.