Before we start let me tell you one straight fact about bond market , it is boring ! to let’s discuss the common question ” So are bonds safe in a stock market crash ?”

Sometimes boring is better specially when the years are like 2022 where market gives you EX-girlfriend’s mom vibe .

Now Stock market crash can happen due to multiple reasons but if the reason is rising interest rate ( just like 2022 ) let’s see how bond market behaves.

Bonds During Rising Interest Rates

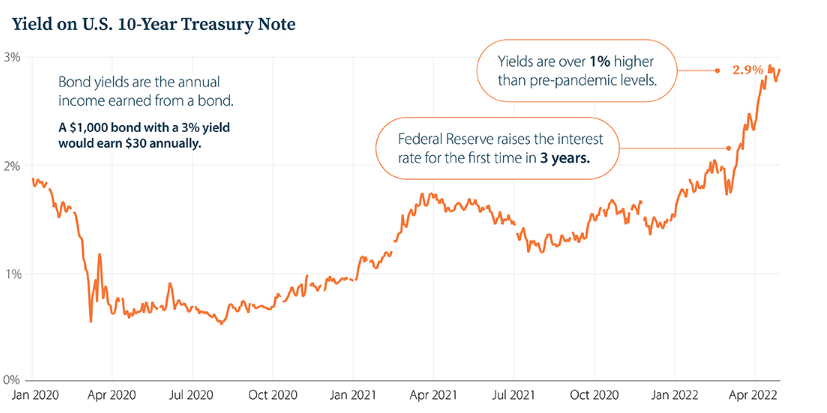

To begin, here’s a quick overview of how interest rates effect bond yields.

Bond yields are the annualized returns that investors can expect from a bond over time. For purchasing debt issued by the government or a firm, bond investors receive interest. A $1,000 bond with a 3% interest, for example, would earn $30 per year.

Rising interest rates have a direct impact on bonds.

Bond yields often rise when interest rates rise. Demand for old lower-yielding bonds falls as investors look for new bonds with greater yields (income). As a result, the value of these existing bonds often decreases.

Let’s look at how bonds have done historically amid rising rates, the potential buying opportunities they bring, and their long-term performance in a rising rate environment, given this backdrop.

Now if you talk to “Twitter” or “TikTok” investors here are the three things you will listen from them over and over but we believe they are incorrect.

Never Hold Bonds When Interest Rates Are Rising

by Someone who failed in accounting class as can’t do math’s.

Bonds have performed well in 38 of the last 42 years, despite numerous times of rising interest rates.

Are bonds safe in a stock market crash ?

Let’s look at the two most recent episodes of rising rates:

| Bond Type | Jun 2004 – Jul 2006 | Dec 2015 – Jan 2019 | Average |

|---|---|---|---|

| Bank Loans | 5.90% | 5.20% | 5.50% |

| Short-Term Bonds | 2.90% | 1.10% | 2.00% |

| Long-Term Bonds | 5.60% | 2.70% | 4.10% |

| High-Yield Bonds | 8.40% | 7.50% | 7.90% |

| Municipal Bonds | 8.40% | 2.70% | 3.80% |

Time intervals calculated from the first Federal Reserve rate hike through one month after the most recent rate hike, when the effective federal funds rate tends to stabilize on average.

Morningstar is the source of this information (Feb 2022)

As previously stated, every sort of bond performed well.

Over the last two rising rate periods, high-yield bonds have returned the most, averaging 7.9%. Furthermore, as demonstrated in the Great Financial Crisis and the COVID-19 market meltdown, bonds have often cushioned losses when equities decline.

This Is the Wrong Time to Buy Bonds

By Investment guru who is living in his mom’s basement and turn 18 today

Rather than being doom and gloom, the current situation may offer a buying opportunity. Consider how municipal (muni) bonds have fared following times of historically low interest rates:

| Time Period | Peak Date | Trough Date | Drawdown (%) | Return (%) 12 Months Following Trough |

|---|---|---|---|---|

| Fed Rate Rise (‘04 – ‘06) | Mar 17, 2004 | May 13, 2004 | -5.29 | 8.65 |

| Subprime Mortgage Collapse/ Global Financial Crisis | Jan 23, 2008 | Oct 16, 2008 | -11.22 | 19.85 |

| Meredith Whitney 60 Minutes Interview | Oct 12, 2010 | Jan 17, 2011 | -6.46 | 15.2 |

| Taper Tantrum | May 2, 2013 | Sep 5, 2013 | -6.77 | 10.22 |

| Trump Election Victory | Jul 6, 2016 | Dec 1, 2016 | -5.71 | 5.95 |

| COVID-19 | Mar 9, 2020 | Mar 23, 2020 | -10.94 | 13.18 |

| Fed Rate Rise (‘22) | Aug 4, 2021 | Mar 16, 2022 | -5.59 | ? |

Bloomberg Municipal Bond Index represents municipal bonds. The data covers the period from January 1, 1994, to April 30, 2022. Meredith Whitney is recognized as “Wall Street’s Oracle.” When Whitney predicted that many municipal bonds would default in 2010, the market was stunned.

Morningstar is the source of this information (Apr 2022)

Municipal bonds recovered significantly in the 12 months after each trough date.

For example, after plunging about 11% during the Global Financial Crisis, munis rose nearly 20% in the year following. Munis may also profit from other important variables, such as strong credit fundamentals and the $350 billion federal stimulus package for state and local governments.

Not only that, but if bond prices fall, a “buy low” opportunity may arise in munis as well as other bond markets.

For Bonds, The Long-Term Prospects Are Dreadful

By Someone who can hardly make breakfast

In a rising rate environment, investors may be able to generate more income from their bond holdings than they would otherwise.

Given the following assumptions, here’s how investors can profit from rising rates as bonds mature:

A aging bond is replaced every year with a fresh 5-year bond.

Each new bond has a yield that is 20 basis points (bps) higher.

| Scenario | Description | Annualized Return of Bond Portfolio After 10 Years |

|---|---|---|

| Scenario 1 | Yields remain unchanged | 1.80% |

| Scenario 2 | Yields fall 100bps across the curve during Year 1 | 1.10% |

| Scenario 3 | Yields rise 100bps across the curve during Year 1 | 2.50% |

Only for illustration purposes, this is a hypothetical case. One basis point is equal to 1/100th of 1%, or 0.01 percent, or 0.0001, and is used to represent the percentage change in a financial instrument.

RBC Global Asset Management is the source of this information (2020)

In the long run, a rising rate environment outperformed a falling rate situation by more than double the bond portfolio’s return.

With this in mind, investors may benefit from active management and a long-term strategy in today’s increasing interest rate environment.

Active fixed income strategies beat passive strategies by diversifying throughout the maturity spectrum while proactively balancing risk and return, according to research. As interest rates change, active methods might search for fresh possibilities, addressing a broader area of the bond market.

The Benefits of Bonds and Are bonds safe in a stock market crash ?

Purchases of freshly issued bonds at higher rates can help counteract the impact of rising inflation and bond yields. While bonds may not appear to be the logical choice for investors in the face of rising interest rates, history shows that they are worth considering.