If you are busy, the answer is yes, They are going up . As of June 17 While writing this article US 30 years mortgage rates are as 5.94% . We expect it to stabilize it around 6.5%.

To begin with, mortgage rates are expensive when compared to 10-year government yields.

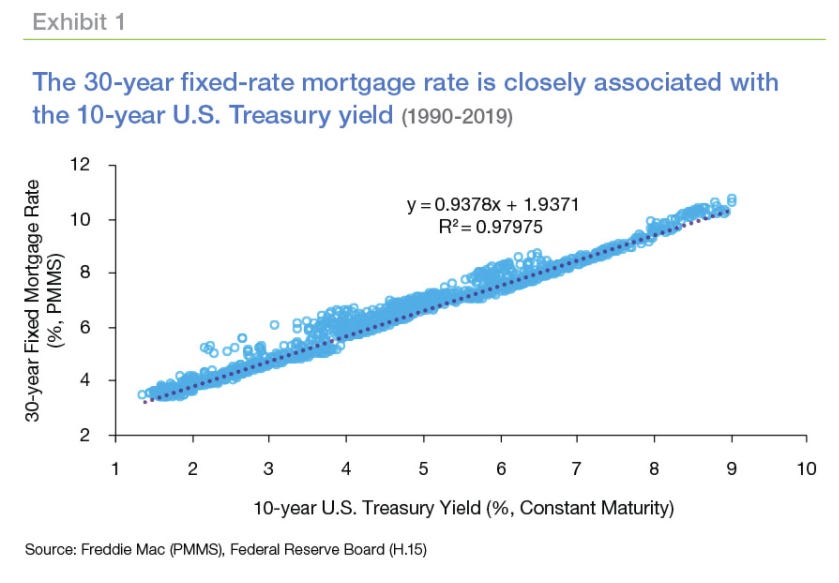

Here’s a graph with a linear fit (using data since 1990). With the 10-year Treasury yield at 2.7 percent, 30-year mortgage rates would typically be around 4.5 percent, according to their formula. The graph, however, shows that there are times when the 30-year is above the trend line.

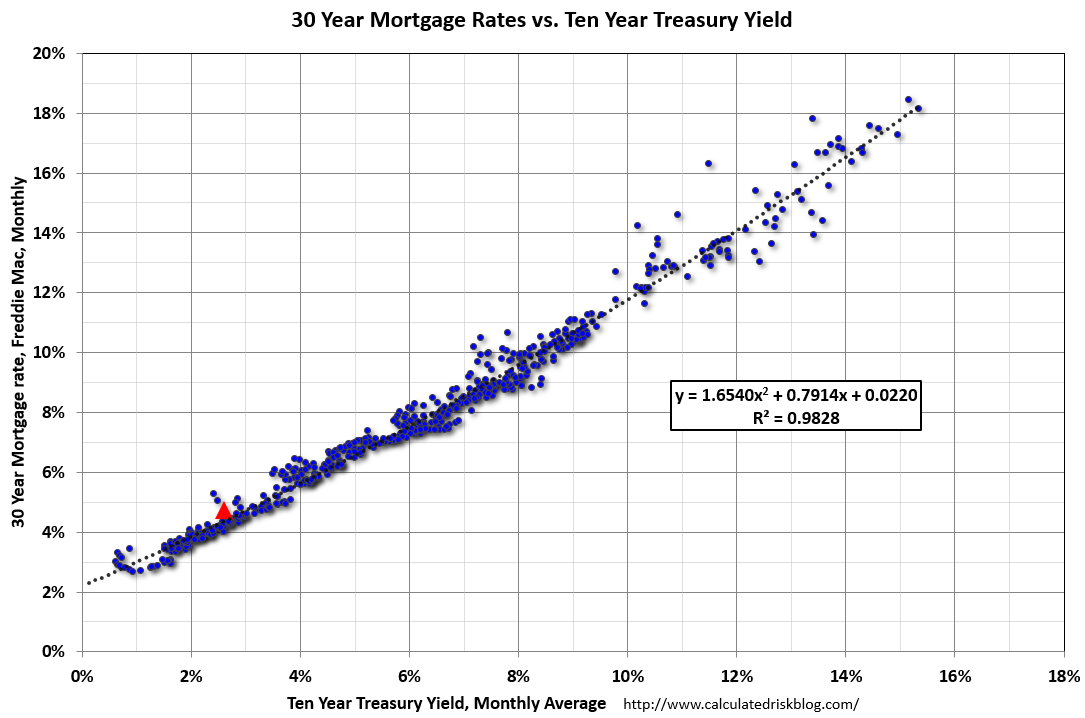

A comparable graph from the Freddie Mac survey since 1971 shows the relationship between the monthly 10-year Treasury Yield and 30-year mortgage rates. The current Freddie Mac PMMS rate is indicated by the large red marker. Mortgage rates should be around 4.5 percent using this formula, but this is still within the typical range – and it appears that investors in mortgage-backed securities are factoring in future interest rate hikes.

The Fed Funds rate is currently expected to climb to roughly 3.25 percent, according to most predictions. Jan Hatzius, the senior economist at Goldman Sachs, has stated that the Fed may have to hike rates over 4%, despite the fact that their baseline prediction is only about 3%.

The yield curve will most likely be pretty flat when the Fed Funds rate reaches its peak in this cycle, meaning the 10-year treasury yield will be around the same level as the Fed Funds rate. The 30-year fixed mortgage will likely peak at between 5.0 percent and 5.7 percent, based on the current projection for the peak Fed Funds rate (3.25 percent to 4.0 percent). Because the relationship is rather variable, we could see rates as high as the low 6% level. (This is dependent on inflation and the Fed Funds rate; nonetheless, I don’t expect rates to rise much higher than they are now, though 6.5% is feasible.)

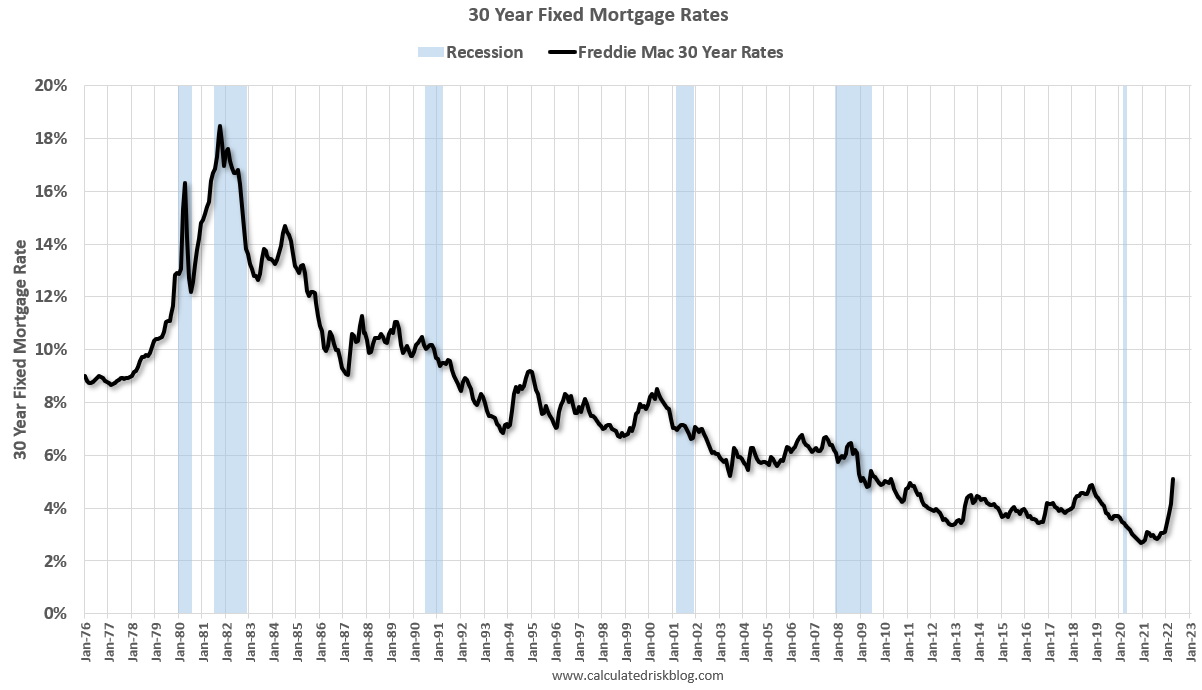

Rates are, of course, still historically low. However, rates have risen sharply from recent lows, and I believe that this is what will have an influence on housing (see my post last month: Housing, the Fed, Interest Rates and Inflation; Housing is a key transmission mechanism for the FOMC). Here’s a chart of 30-year mortgage rates over time (Freddie Mac PMMS, March is the current rate).

How do higher mortgage rates will impact Housing market ?

Affordability will be impacted by higher rates. Affordability has dropped to levels not seen since the housing bust, based on today’s mortgage rates.

It’s crucial to note, however, that if mortgage rates double from 2.5 percent to 5.0 percent, monthly payments will not double. Payments for principle and interest would grow by around 35 percent in this scenario, and payments for taxes and insurance (PITI) would increase by about 25 percent. Although this is a significant increase, mortgage payments do not double when interest rates double.

Assume a household has a down payment of $100,000 and can pay $2,000 per month in PITI. With a 2.5 percent mortgage rate, they could afford a $485,000 home.

Using the same assumptions, and assuming a 5.0 percent mortgage rate, this family could buy a $400,000 home, which is around 17% less.

The pool of purchasers at each price tier will shrink as mortgage rates rise, potentially slowing house price growth.

I’ll write a lot more on how increased mortgage rates affect house prices, inventory, new home sales, and housing starts in the future.

In conclusion:

Rates on 30-year mortgages are currently at 5.94 percent.

Mortgage rates are likely to reach their peak for this cycle (depending on inflation), but they could increase to the low 6.5% level if the Fed is forced to hike rates to 4%.