Long believed to be the time of night when witches, devils, ghosts, and other supernatural beings are most active is the “witching hour.” It turns out that this is also the most powerful time for the US stock market.

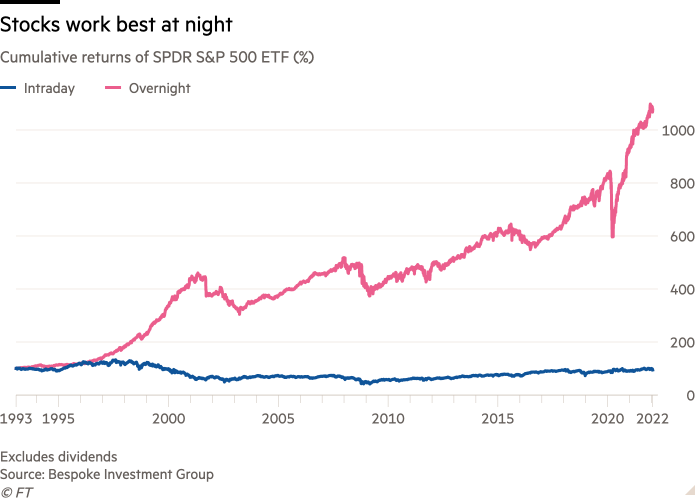

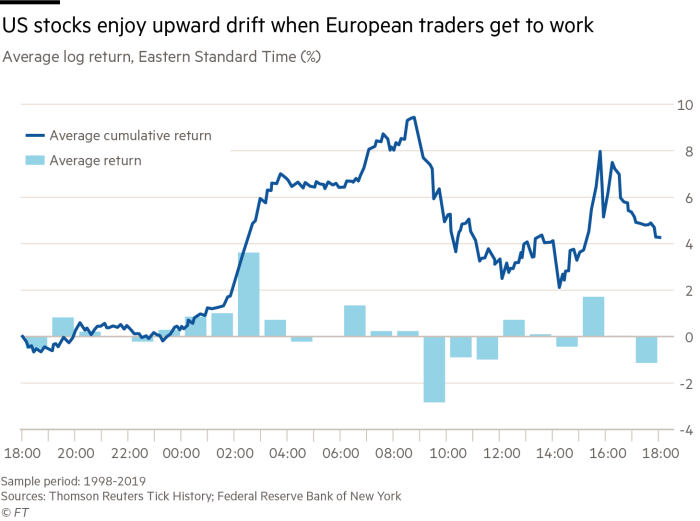

According to a New York Federal Reserve study, although American stock markets are formally open from 9.30 am to 4 pm in New York, the majority of gains really occur during the lighter, less formal after-market trading that takes place on multiple electronic platforms. On the other side, early morning returns typically have a negative trend. Many analysts have long been baffled by the phenomenon.

When markets are closed and liquidity is tight, “quant” funds that employ algorithmic or systemic techniques profit from the greater impact that trades can have. They purchase shares aggressively, which raises the price of the ones they currently own.

They can then gradually stop making the purchases as markets open and trade circumstances get better without completely erasing their previous effects. At the end of the day, they need to have a portfolio with a somewhat higher worth. If this were consistently done, day in and day out, it would result in the pattern of overnight increases and gradual intraday losses.

Numerous other technical aspects, such as derivatives or index fund purchases during the closing auction, are likely to have a significant impact. Quants dismiss Knuteson’s theory, claiming that any advantages from such a strategy would almost likely be offset by the costs of trading and insurance against any catastrophic falls while the portfolio is bloated.

And it beggars comprehension that large hedge funds could routinely manipulate markets on such a staggering scale over a long period of time and in numerous different nations without a single regulator, trading company, or money manager noticing.

Capturing the night effect :

Researchers in the capital markets have demonstrated that the Night Effect can benefit investors. it’s better than Simply continuing to invest for the entire 24-hour period. However, numerous people have noted that that capturing the Night Effect could possibly incur transaction costs greater than the potential benefits. the benefit that the Night Effect offers. Undoubtedly, a broad index-focused approach that invests in all the A high price could result by buying assets at their respective weights each night and selling them the next morning.

the amount of transaction expenses needed to offset the Night Effect’s value. Fortunately, knowledgeable investors can implement their plans using a range of financial instruments.

What is NSPY EFF ?

it is SPY but trading at night time. it buys $SPY at the close and sells it at the open let the effect of night works on the price , Will be interesting to see how it behaves in long term.