fine 2022 is kinda screw us all , but let’s not take downturn of this year lower our hopes for 2023, we have got the perfect list of 10 stocks which gives high growth and good dividend for you to invest. check out 10 best stocks to buy in 2023.

No.10 is lovesack

Ticker symbol $LOVE now you may or may not have heard of lovesack but they’re disrupting the furniture industry by designing manufacturing and selling furniture in-house both in stores but also mostly online through online digital sales.

They currently have 146 retail showrooms and their current price is sitting at around about $32 this is down $50 from their all-time highs which makes this high this stock highly appealing to me now as this stock took a hit along with the recent tech sell-off. There are a few positive catalysts on why you should get into this stock sooner than later taking a look at their P/E ratio it’s an amazing 11.60 and their market cap is currently 449 million dollars plus .

Lovesack sales are an increase by 56 to 129.4 million dollars with double-digit sales from both its showrooms and e-commerce section so many people believe a recession is looming pretty much already done but with the FED indicating that inflation should start going down soon and supply chain bottlenecks starting to ease up this is definitely a sleeper stock to pick for 2023.

No.9 Monolithic power systems

Ticker $MPWR. When you see an opportunity you take it and that’s a situation with monolithic power systems incorporated they specialize in providing power circuits found in cloud computing telecom infrastructures automotive industrial and consumer applications. Currently the stock price for the company sits at around about four hundred and forty dollars which is thirty percent below the all-time high of five hundred and eighty dollars in November 2021. This decline presents an opportunity for potential buyers to buy the dip that could be you monolithic power has a median EPS growth of 12 over the same period this tells us that this 22 billion company is growing its earnings at more than twice the average rate for the rest of the stock market and its earnings growth is expected to continuously increase over time.

As a bonus MPWR offers a dividend yield of 0.7 to its shareholders analysts from yahoo finance CNN and tip ranks all give this stock a strong buy now indicator with an average upside of 20 within the next 12 months.

No. 8 Ubiquity incorporated .

Ticker $UI. Ubiquity this communication device company operates wireless and network equipment for internet service providers . ISPS analysts believe that this company whose 415 billion market cap will continue to project impressive growth in both earning per share growth and annual earning growth for years to come so despite the tax sell-off.

It’s held up remarkably well just down eight percent year-to-date and to add a cherry on top ubiquity has been increasing their dividend payout every year since 2014. Current dividend yield is at 0.9

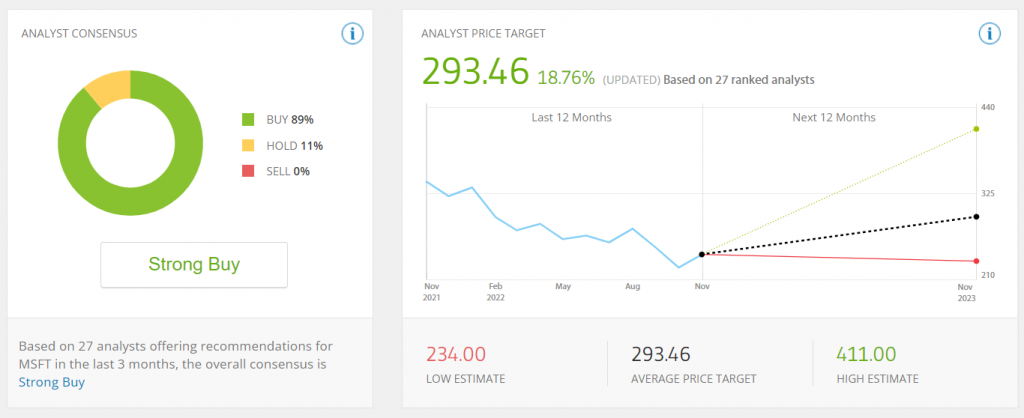

No.7 Microsoft co-op

Ticker $MSFT .Easily the most recognizable name on the list Microsoft corp needs no introduction and is a number seven on my list from gaming Microsoft office suite LinkedIn to their fast growing cloud computing division Microsoft has been a mainstays one of the largest and most successful companies.

They’ve got a two trillion dollar market cap while microsoft’s prices are currently down 21% from their all-time high. Analysts expect that the company’s annual EPS will grow by 16 over the next five years. This makes it a perfect time to build a position in this blue chip yet high growth tech stock. Microsoft’s annual eps increased an average of 24 over the last three years driven by an average revenue increase of 15, 2.2 per year so there’s little question if Microsoft can bounce back.

honestly it’s just a matter of when including the projects related to building out the metaverse microsoft is at the forefront of techno technology and growth.

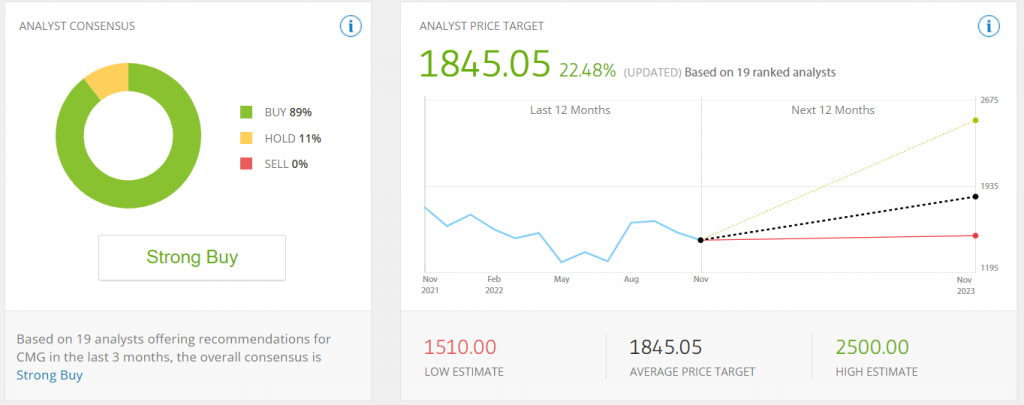

No.6 chipotle Mexican grill

stock ticker $CMG .Easily recognizable by Americans and maybe the most popular a la carte fast food restaurant out there. Chipotle has been a fan favorite by both Mexican food lovers and stockholders of this company. Currently chipotle has a steep 30% discount below its average price making this a good entry point for long-term holders.

Those who bite this deal can be reassured that chipotle’s prices will likely increase as both the company’s earning and revenue growth sit at an impressive 49% and 16% respectively. you know with many analysts expecting a 27 average annual eps growth over the next five years though the price is still a pretty astounding 1500 it’s still on discount based on its all-time high of 1 937.

No.5 ASML holding stock

Ticker $ASML.This Netherlands based semiconductor company focuses on making microchips for big clients such as Samsung and intel. it has a market cap of 222 billion dollars making it one of the largest semiconductor companies in the whole world . shares of asml are up a total of 200 over the past five years although its current price is about 48 below its september 2021 all-time high price of 895 dollars per share plus the senate just advanced a bill to boost u.s semiconductor production which works well for this company.

As the high demand of chip production is at an all-time high i think the current decline in price as well as the recent news makes this company a great 2023 investment and honestly for many years to come

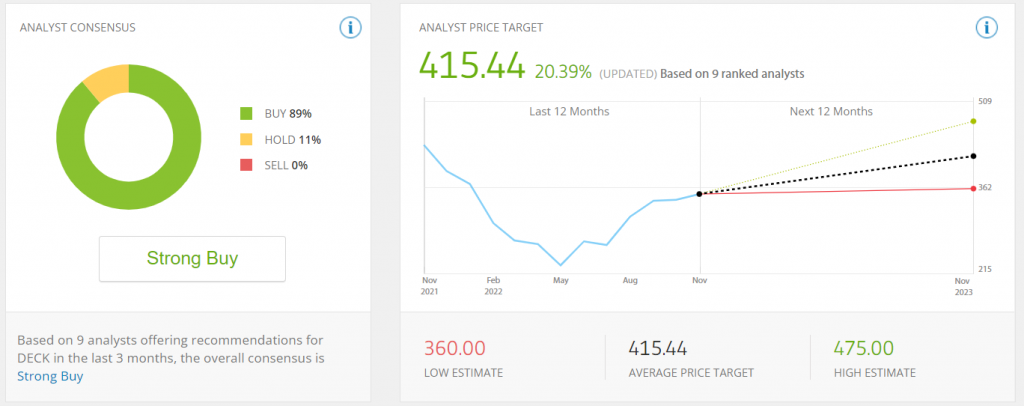

No.4 Decker’s outdoor corp stock

Ticker DECK. so for those of you looking to invest in a stock with a good P/E ratio then decker’s outdoor corp is perfect for you offering a current P/E ratio of 16.6 and a forward ratio of 14.02.

This company specializes in designing marketing and distributing footwear apparel and accessories for casual lifestyle use and high performance activities with subsidiaries like ugg tv and hoka decker is just now becoming a popular mainstream footwear play and their revenue sales are up 31% year-over-year.Their price is down 35 from their all-time high and it definitely looks like a bargain that i think is ready to explode in 2023.

No.3 medifast

Ticker $MED . medifast health companies are always a safe bet for investors as pretty much they’re always in demand and medifast is no exception so this two billion dollar company has tripled its total revenue since 2018 and its three-year average annual increase is currently sitting at 38 percent . medifast manufactures and distributes weight loss nutritional and healthy living products in the united states and in Asia.In the past five years they’re up 294 percent but year-to-date they’re down 21 which i think makes it a great buying opportunity but maybe the best part of all is that medifast offers the highest dividend on this list at a whopping 3.6

No.2 intuit incorporated

Sock ticker of $INTU.Those looking to capitalize on another annual growth stock intuit comes in at number two on my list with a market cap of 122 billion dollars their financial management products such as QuickBooks have been a household name for large and small businesses and even people like me I’ve been using quickbooks for years .

Their tax software is also regarded as one of the best and easiest to use which makes them a reliable company to churn out great earnings year after year because taxes are always here the price of intuit has recently fallen by more than 35 from its november 2021 high , currently sits at 433..Because of this steep drop this is better for those looking for a long-term buyer this 116 billion software company has an impressive three-year average sale of 25 and EPS growth at 17.5 percent .

Final and at

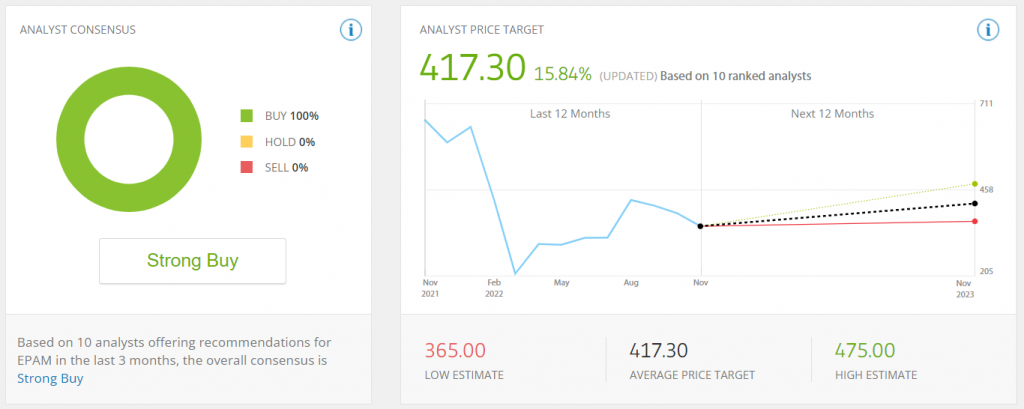

No.1 EPAM systems

stock ticker EPAM. EPAM systems incorporated it’s a software engineering and design firm epam had a huge drop from its all-time highs of 720 per share back in november 2021 and now has a sweet sweet price of 325 .

EPAM specializes in digital platform engineering digital product design and is considered one of the world’s largest manufacturers of custom software and consulting providers.In march EPAM was down as much as 76 from its november 2021 high.

it has since recovered somewhat but remains more than 50 below its November highs. According to analysts yearly earning growth will go around 19 for the next five years and analysts from yahoo finance CNN and tip ranks give it a strong buy rating now while each expecting to reach a 26 upside within the next 12 months.

so they were my top 10 best stocks to buy for 2023 which ones are you interested in let me know in the comments below don’t forget check our twitter and chart section .

Remember in order to invest in your future you need to invest in yourself good luck with your stock investing in 2023.