If you are reading this at the end of 2022 this is potentially going to be a once in a generation opportunity to build wealth because now it could be one of the easiest times to increase your net worth dramatically.

if you know what you’re doing after all there’s a popular saying that riches are made in recessions and it doesn’t take much to realize that we’re already beginning to move towards that point just take a look at the headlines today

“ more than 9 out of 10 CEOs are bracing for a recession “

News headline by CNBC

97 CFOs are cutting costs by 10%

News headline

Also

“JP Morgan warns the stock market Could Fall by another easy 20% from current levels.”

JP morgan news headline

now even though this sounds negative the fact is recessions happen on a regular basis and if used correctly it’s possible to set yourself up for the rest of your life through some incredible opportunities and discounts with even Warren Buffett being quoted as saying

“ bad news is an Investor’s best friend “

so let’s talk about exactly what’s expected to happen throughout these next 12 to 24 months. So let’s deep dive and first answer this?

What happens in Recession ?

- Rise in unemployment

- A drop in wages

- loss in consumer confidence

- Decline in values across everything from stocks food energy and services.

- Recession also triggers a decline in earnings ( see every quarter companies report the revenue and give guidance on their future outlook but lately they’ve been cutting forecasts bracing for slow or even negative growth inciting recession )

- Mass Tech layoffs

as Bank of America explains the U.S economy will soon start losing 175 000 jobs per month .

So How to make money and what to do with your investment in 2023 ?

Let’s start with stocks :

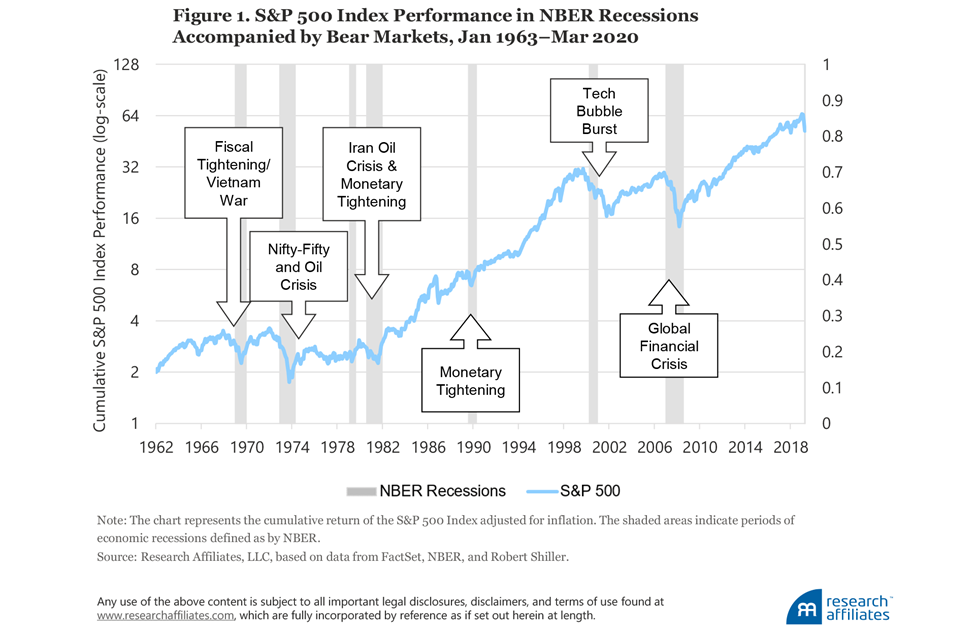

As of now all three major indexes are down between 20 and 30% . Analysts like JP Morgan who believe that we have another 20% to go from current levels . however if we take a look throughout history since 1946 the average bear Market drop was close to 30% .The most severe having been in 2009 when the S&P 500 fell 57% from the peak. During the recession bear markets tend to do even worse with an average drop of 34.8% . As of today we’re down about 25% .

all of that is to say that generally the absolute bottom occurs when we see capitulation across investors usually that’s a time of the start of the recovery and things begin to bounce back now.

What about Real estate :

even though every area is different and some locations might continue to flourish. housing declines on a national level are actually incredibly rare. In fact as you can see throughout the last 60 years there have only been a few times where prices meaningfully fell more than 10% . but now the general Wall Street consensus is that National housing prices are going to decline 7% with a worst case decline of 10 to 15 % , should interest rates continue to increase of course every Market is going to be different and according to Moody’s Analytics the most vulnerable markets could see upwards of a 25% decline from the peak .

This includes parts of Florida , Arizona, Idaho and Southern California with the decline lasting another 12 to 18 months before bottoming out..Now in the big picture it’s probably not going to make that big of a difference for anybody with a fixed rate mortgage who intends to stay in their property for another five to ten years but for anyone looking to invest or buy a house we may begin to see some deals starting to come on the market .

Let’s talk about Cash :

clearly up until now there’s been this mindset that cash is wasting away to inflation but when every other asset is falling in price sometimes cash could be the safest place to store your wealth and you know that’s significant when someone like the billionaire Ray dalio admits that cash is no longer trash. The truth is many people forget that as recent as 2018 cash was the best performing asset. And if you had just been saving your money in a high-yield savings account you would have far outpaced the market. cash is now becoming such a significant part of the portfolio that even fund managers are holding on to the highest amount of cash since 2001 .

Citigroup said that cash is the only asset that investors could use as a recession hedge.

But if you truly want to get “rich” you should take advantage of this hard earn cash.

That brings us back to the start,

Should you buy stocks and start investing?

Even though a person might think this is a bad time to invest when everything is falling .

30% wealthy person would see this as an opportunity to be able to buy those exact same companies .

Warren Buffett really had the perfect analogy for this he said

“when hamburger go down in price we sing when hamburgers go up in price we weep”

for most people it’s the same thing with everything in life .They’re buying everything , except for stocks . when stocks go down , people don’t like them anymore .

so first reframe your belief because a falling Market could work to your advantage , the second there’s less competition. the fact is when times are difficult companies scale back , they play it safe . but this opens the door for smaller more aggressive companies to stand out and take their place for example one study across 16,000 companies found that those who continue to advertise increase their value and got more bang for the buck with Positive Growth years after the recession.

Patrick David made a fantastic comparison a few months ago that the peak of the market cycle is exactly like a forest this means that only the largest most established trees or companies get access to all the resources or in this case sunlight , everything at the bottom has a difficult time being able to compete and it’s hard to grow. just like natural forest fires , our economy has a way of repeatedly clearing out and bankrupting the companies who no longer are able to sustain themselves , giving opportunities for newer smaller businesses to continue to develop .

After every bear Market comes a bull market as Yahoo finance points out historically the S&P 500 has fallen an average of 29% around a recession with a median drop of 24% but once stocks have found their low their average return the following year is 40% . within next two years the market has increased an average of 58 %. this means that investing in the way down is much more profitable than pulling out of the market.

How to know if we are in recession ?

No one will call it officially you need to feel it. for example the Great Recession that began in December of 2007 was not officially announced until December of 2008, only a few months before it officially ended .

Another example the recession that began in March of 2001 but they didn’t call it a recession until November . later that year and this continues with about a 6 to 12 month delay until we actually know we are in a confirmed recession .

How to get rich in Recession in 2023 ?

- Cut back expenses

- Hold on to cash

- Protect your job

- Invest long term

Do follow to our twitter and check out chart section for interesting investment related charts.