Here’s how the narrow-minded think about whenever stock market blow ups or crash.

“Next time mortgages are made readily available to unqualified homebuyers, I’ll be really careful!”

Or …

“Next time owners of internet companies without any profits try to sell me an IPO at billion dollar valuations, I’ll definitely stay away!”

Because of recent (and ongoing) events in the stock market, We drilled down in the history and collected all the previous stock market crashes.

We shall see that these failures have something that they can teach us – as long as we don’t get bogged down in the particulars like these guys. Of course, hindsight is always 20/20, but forewarned is forearmed – If we’re paying attention.

This is a summary of 5 of the most devastating stock market crashes in history inspired by the book “A History of the United States in Five Crashes” written by Scott Nations.

Crash No 1 : 1907 – The panic In

1898, rules were introduced that allowed a company to own another company. This created the first corporate trusts – simply holding companies of many other companies. With this, truly large corporations were created, such as Standard Oil and Northern Securities, and these trusts represented a large part of the total stock market in the early 1900s .

Theodore Roosevelt, the then president, thought that these companies were like monopolies that hindered American trade. He thought that they were depriving the public of the advantages of free trade, so he started to go after them, taking many of them to court.

Markets saw Roosevelt’s move as very unpredictable and didn’t know how far he’d go in this witch-hunt. As is always the case, uncertainty is the harbinger of stock market crashes

Meanwhile, in 1906, a great earthquake struck San Francisco. More than half of the city’s population of 400,000 people were left homeless as a result. Homeowners didn’t typically have insurance against earthquakes, but they did have against fire. So what did they do? If a house was damaged by the ruptures but spared the flames, people typically set their own homes ablaze . Many of the insurers were from Britain, and the Bank of England had to pay a lot of gold in insurance claims here .

Britain was tied to the gold standard at that time and to restore the gold vaults it started offering higher interest rates to borrowers . The trust companies weren’t typically regulated in the same way as banks in that they didn’t have to keep as much collateral or equity on their balance sheets.

In this way, they were able to leverage deposits more to offer higher interest rates to customers to beat those offered by the British. So the scene was set up … Now all that was necessary was a small ignition – a catalyst – for the whole system to go down . And in October 1907, it got one.

It all started when there was a failed attempt of stock manipulation in a company called United Copper . As a result, the stock fell tremendously. This caused banks and corporate trusts that had used the stock as collateral to fall into financial difficulties . People who had deposited their money in these companies sensed this and immediately wanted their money back, causing numerous runs on these banks and trusts. And so … the panic of 1907 was a fact .

US market during 1907 crash

The Dow Jones Industrial Average hit a low of 53 on November 15th 1907 , after reaching 103 at the top On January 19th 1906 . The market would regain almost the whole loss by the end of 1909 . Also, note that the market rallied 42% in 1904 and 38% in 1905 before beginning to halt in 1906 and then come crashing down in 1907.

Cash no. 2 : 1929 – The Great Depression :

The Federal Reserve was founded in 1913 as a response to the 1907 panic, when JP Morgan together with a few other bankers had to step up as the “lender of last resort” to save the market.

The government thought that they should have that responsibility instead The Fed rules over the so-called discount rate, which essentially is the interest rate that banks can borrow at . In 1924, this was lowered to the then record low level of 3% . This fueled the American stock market. When money is cheap, stock ownership becomes easier to finance and it also becomes relatively more attractive to bonds. It is hilarious to compare the then record low rate of 3% to what we see today, by the way .

Easy money during 1929

Meanwhile, disappointed by the low interest rates, corporations and rich individuals started to offer “call money” – essentially loans issued to other investors. This was primarily used for stock market speculation and it provided slightly higher interest rates than those offered by the banks.

The 1920s were referred to as the roaring 20s because the market truly rallied during those years. Because of this, many investment trusts were formed and it was easy to attract capital from individuals that had never owned a single stock before . You could see that his speculation had gone too far when brokers started opening temporary offices at cruising ships and golf courts in order to allow investors and speculators to place orders basically anywhere in the world.

Anyhow, these investment trusts were quiet sober, but only until they started using a lot of leverage – especially call money. It wasn’t unusual to use at least two times more borrowed capital than equity. Now, all that was needed was a little “push”, and a large investor in London called Clarence Hatry tree offered one.

He was revealed to be a fraud, and to have fooled many banks into borrowing him money using fake stock certificates as collateral. Investors in both Britain and America became suspicious after this, wondering: what were their certificates worth if even banks could be fooled so easily?

The basic soundness of the market was questioned Once the market started to slip, brokers had to issue margin calls to individuals and investment trusts. Many of them were too leveraged and couldn’t put up the additional money. The result was that the stocks were immediately liquidated, and so, the Great Depression had begun.

The Dow Jones Industrial Average hit a low of 41 on July 1932. This was even lower than the bottom of the panic of 1907! The top was at 381 on September the 3rd 1929. which means that the market fell almost 90% during these three years Crazy!

US market during 1928 crisis / crash

Also, the market wouldn’t return to the levels of 1929 until November 23rd 1954, as much as 25 years later. Sure, there was the Second World War in between here. But still, this crash was absolutely insane! Also note that the market rallied 29% in in 1927 and 48% in 1928.

Crash no. 3 : 1987 – Black Monday

Portfolio insurance was supposed to be a financial innovation that allowed investors to sit safely through market crashes, so they could later enjoy the rallies that typically follows. A small fee was paid upfront to essentially ensure your portfolio from falling below a certain level. In a small scale it would have been a very successful financial innovation, but the problem was that on a larger scale, portfolio insurance had many flawed assumptions.

Portfolio Insurance Cause of 1987 Crisis :

One of them was that stock prices move smoothly Another one that there would be enough liquidity for all the sell orders that were necessary to hedge against the downside. But someone calculated that just a 3% drop in the market would encourage selling that was equivalent to a whole day of trading in S&P500 futures. And this was for just one of the firms using portfolio insurance!

Leveraged buyouts of companies became popularized during the 1980s. Companies buying each other using a shit-ton of leverage This spurred the stock market on. The trade deficit of the US had mushroomed, 8 times larger in 1986 than in 1981. As a result, the dollar was weakening.

The Fed responded by increasing interest rates. It wanted the supply of the dollar to decrease to stabilize the value of the currency. The higher interest rates made the stock market relatively less attractive to bonds, after the stock market had been spurred on for many many years.

On Monday morning October 19th, 1987 the US attacked Iran, firing missiles at military targets in the Persian Gulf in a retaliation attack. No one could blame people for thinking that the US was at war with Iran when waking up this morning. The missiles would trigger an initial downturn in the stock market which in turn would trigger portfolio insurance sales that were too great for the market to handle.

Sell orders activated more sell orders, which activated more sell orders, which activated even more sell orders, which activated even … You get the point. Black Monday was born.

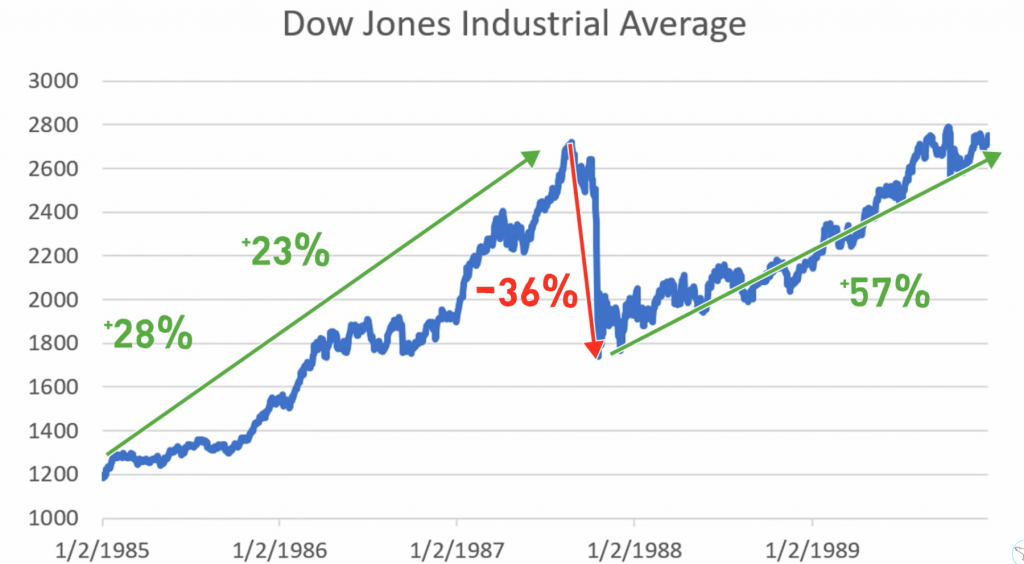

US market during 1987 Crisis /Crash

After the top of 2722 ,on August 25th 1987. the bottom of 1739 was hit on the day of Black Monday, October 19th 1987. The Dow was down 22.6% on the day, which is the largest loss in a single day in the history of the stock market. The next top would be reached two years later, on August 24th 1989. Notice that the Dow was up 28% in in 1985 and 23% in 1986.

Crash no. 4 : 2008 – The financial crisis :

Mortgage-backed securities, or MBSs were created by pooling a portfolio of mortgages. By choosing borrowers carefully, the pool could be very secure, and have higher interest rates than for example governmental bonds. So far so good. But what was going to be a large problem much later, was that the mortgage issuers didn’t have any skin in the game any longer.

If the loans that they issued defaulted it didn’t matter since they had already sold these off to someone else who had pooled them, and then sold them to investors. Many of the MBSs were to be backed by people with poor credit and by houses in a real estate bubble.

Issues with Mortgage backed securities

The first MBS was created in 1970 though, long before the eventual crash. Home ownership was (and still is) seen as something of great importance to self-esteem and life satisfaction. Politicians therefore wanted everyone to own a home – even those with very questionable finances.

They accomplished this by lowering the required standards of mortgage down payments – all the way down to 0. with the installment of the Bush administration in 2001. Because of these “subprime” mortgages, the whole market was open to many more buyers and so, home prices increased sharply.

Not many investors were interested in the lower grades of MBSs – those that consisted of portfolios of these subprime loans. A special type of MBS, the so-called collateralized debt obligation or CDO, proved to be the solution. It had been used previously for other types of loans, but was now applied to mortgages.

It worked something like this: If you pile enough crappy loans on top of each other, you can get something safe and sound, thanks to diversification. This was going to be proven to be a flawed assumption.

Another innovation was the credit default swap, or CDS. Not to be mistaken with the previously mentioned CDO (It’s as if someone made this whole thing confusing so it was easy to get away with).

The CDS was an insurance that company A could buy from Company B that promised that, in the event that Company C, which had borrowed money from Company A, couldn’t fulfill its obligations, Company B would step in and pay.

These were now applied to mortgages and other loans between financial institutions – making the whole system interconnected Finally, we had the rating agencies.

These companies were (and still are) responsible for giving securities ratings based on their default risk. An they were either fraudulent or stupid (or perhaps a little bit of both) as they rated many of the subprime backed MBSs AAA, which means the lowest possible risk of default!

AAA MBSs didn’t require much collateral to secure through CDSs and allowed for more borrowing, as the risk of default were deemed so low. now A whole system was basically focused around home prices, and if they were to fall, chain reactions would be felt throughout the whole financial system. And then … they fell.

The catalyst of this crash was that the investment bank Lehman Brothers went bankrupt on September 15th 2008. The interconnectedness of financial firms threatened the whole economical system and the crisis was a fact.

US market in 2008 financial crisis :

The high was reached on October 9th 2007 at 14,164, and the bottom on March 9th 2009 at 6547. Once again, the market had gained quite a lot before the crash happened – in 2006 16% and up until the top of 2007, 14%. Not as much as during the previous crashes though. The next top wouldn’t be reached until March 5th, 2013, but before that, another crash was lurking around the corner.

Crash no. 5 : 2010 – The flash crash

Allow me to be brief here. Greece wanted to become a part of the new common currency of Europe – the Euro. It tricked itself into the union in 2001, by using financial shenanigans that made it seem like it fulfilled the financial criteria of the union. It went on a borrowing binge between 2000 and 2010, and in early 2010. it seemed like it would default on its debt.

A member of Angela Merkel of Germany’s coalition said that: “You don’t help an alcoholic by putting a bottle of schnapps in front of him!” But no matter, the IMF provided Greece with a loan to help it survive. But the conditions of the loan were painful for the people of Greece.

During Black Monday of 1987, the worst day in the history of the stock market, at least trades were executed by humans. On May 6th, 2010, the crash was caused by computer algorithms going crazy. Basically, the main algorithm causing the crash used the same technique of dynamic hedging that had caused the crash in 1987.

The catalyst of the flash crash was riots in Greece on May 6th that happened after its government had accepted the conditions of the loan from IMF. The riots started the initial crash that was enough for a firm called Waddell & Reed to try to hedge its portfolio before the market closed. An algorithm provided by the British bank Barclays was used.

Waddell & Reed didn’t have much time to execute this hedging, so they decided that the algorithm wouldn’t stop at any price, but instead be totally dependent on the volume traded in the market.

The only problem was that the volume was going to snowball once Waddell & Reed tried to sell so much. A higher volume suggested to the algorithm that the market was more liquid and that more sell orders could be filled. The selling became self reinforcing and liquidity disappeared when it was needed the most.

On May 6th 2010 the Dow fell to 9869 intraday, down 9.2% for the day. What’s extra interesting about the flash crash is that because of the reckless selling of the algorithms, some companies traded at truly stupid levels, levels which no human would execute a trade at.

On that day, more than 3 million shares were traded at 90% or lower than the previous day’s close. Think about it! What if you could buy Apple at $28 or Coca-Cola at $4, if only for an instant Would you do it?

Perhaps you have already noticed, but these crashes share three common characteristics –

- There had been a creation of a new financial innovation or unproven new products

- There was leverage – all too much leverage

- The stock market had had two years of strong market returns just before the crash

with the exception of The flash crash. The catalyst is the unknown, but with these conditions in place, we know that there’s a tendency for markets to fall apart, no matter what the particular catalyst may be.

The most important thing to remember from this article is probably this though: The market always rebounds.

All 5 US market Crashes , followed by Market returns

Great rewards await those who stay in the market for the later upswing.

Do follow us on twitter and don’t forget to share this with your friends. Happy investing.

Also check our chart section to know more.