from year 2008 till 2021. it was Easy to become Aggressive investor and stock market has given good return to such investors. But as of now writing this article in 2022 November , stock market has dropped as much as 27% and recover from the lows. now at 17% from all time high. Oh boy, that is quite a volatile market. in this article we will talk about three types of investors Conservative vs moderate vs aggressive investors and decide which is best suited for you.

Let’s first start with Definition of All :

What is Conservative investors ?

Investors who invest into lower-risk securities including blue chip stocks like fixed-income securities, the money market and cash or cash equivalents. Conservative investing aims to safeguard the value of an investment portfolio.

In a conservative investing approach , investment is done in debt securities and cash equivalents. Less into stocks or other riskier assets. This typically makes up more than half of a investment portfolio. Aggressive investing can be compared to conservative investing.

What is Moderate investors ?

A moderate investor places equal priority on lowering risks and raising rewards. In order to pursue larger long-term returns, this investor is prepared to take on minor risks. A moderate investor might put up with a temporary loss of principal and less liquidity in exchange for long-term growth.

What is Aggressive investors ?

A risk-taking investor who values maximization of profits is said to be aggressive. According to this investor, maximizing long-term profits is more significant than safeguarding principal. An aggressive investor may experience significant losses and high volatility. An aggressive investor generally has no concerns about liquidity.

Conservative vs moderate vs aggressive investors invest into :

Below table shows what each type of investors likes , when Conservative investors tend to favor more boring and slow growth asset classes , Aggressive investors likes to prefer more of fast growing and high volatile assets.

| Conservative Investors | Moderate Investors | Aggressive investors |

| Certificate of Deposits | Corporate Bonds | Common Stocks |

| Government Bonds | Indexed Annuities | Stock mutual funds |

| Fixed Annuities | Preferred Stock | Commodities |

| Insured Municipal bonds | Non-Publicly Traded REITs | Speculative Real Estate |

| Follows Wallstreetbets 😉 |

What is the best investment strategy ?

Of course there is no direct answer to it though I would say Moderate investment strategy is the best one along with little aggressiveness for the dip buying. To explain this let’s look at the below chart

if you can see The volatility is high for aggressive investors but returns are also quite significant.

| Conservative | Moderate | Aggressive | |

| Average Annual Return | 4.7% | 6.9% | 9.4% |

| Standard Deviation | 6.1% | 9.7% | 14.5% |

| Worst Month | -7.1% | -11.1% | -17.1% |

it’s clear to see that conservative investors sleep much better at night. while aggressive investors might get nightmare when their worst months are down as much as 17.1% ! this is quite significant pressure on heart .

Let’s rate each of these investment strategy based on different parameters.

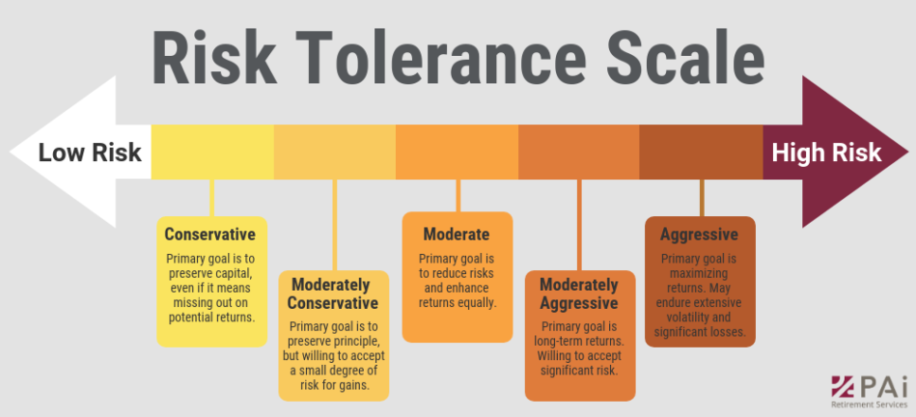

Based on Risk Tolerance best is Conservative investors :

Evaluate whether you are an optimist or a pessimist in order to determine your risk tolerance. If you’re an optimist, you think that opportunities will come your way and that things will get better from here. In that situation, you’ll probably be more willing to take a chance. On the other side ,if you’re pessimistic, you probably want to take fewer risks. Because you think that the future won’t be as good as the present. Consider your attitude toward money as the greatest approach to gauge your risk tolerance.

Based on Return best is Aggressive investor

No doubt with high risk comes high rewards, if we analyze last 50 years of data S&P500 has given an annual return of 11%.Which is amazing. If you are smart-aggressive investor in US market you might have been rewarded well , provided you held up well during the volatility .

based on research 70-80% hedge funds or fund manager managed to underperform S&P500 index. yes you heard it right . These fund managers and hedge funds are aggressive investors yet they didn’t manage to outperform the market. Reason is simple they cant handle the volatility .

Based on Time horizon and your age :

Investment strategy is not like 1 fits all. Depending on what is your age and time horizon it varies person to person.

Diversifying your portfolio is a regular process. For instance, younger investors are sometimes urged to invest more in equities than bonds because longer exposure to the market reduces risk.

But if you are mature or senior citizen , Because there are fewer years left before retirement. It is typical for investors to change the asset allocation of their portfolios from stocks to bonds.

Naturally, regardless of age, your risk tolerance must be taken into account when choosing an asset allocation.

Conclusion:

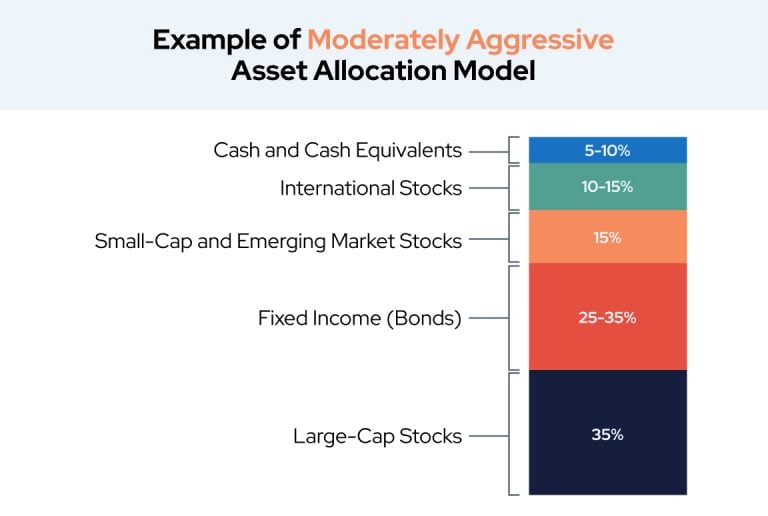

If you are age 30-45 best strategy for you is Moderately aggressive investment.

you have more time in life along with higher risk tolerance , typical portfolio of your investment should look like as below. You have 5-10% of cash , 35-45% invested into stock market. At the same time you have Fixed income bonds around 25-35% to keep your portfolio balance during market down turn.

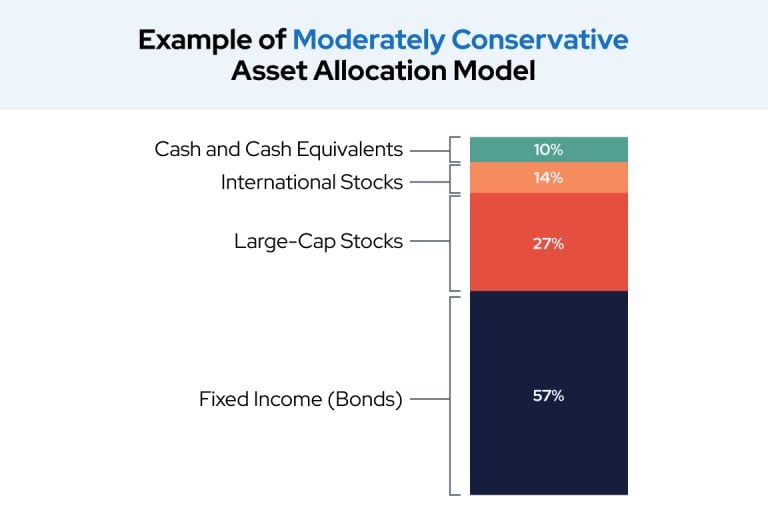

If you are age 46-70 best strategy for you is Conservatively Moderate investment.

This is relatively safe way of investing , where You hold 60-70% of your portfolio with safe assets while risking only 15-20% of it into Large cap stocks with good dividend payout and international large cap stocks. This is perfect if you are nearing retirement age .This gives better peace of mind and stable dividend or interest payment ranging from 1% to 3-4% based on type of dividend or bonds you are into.

Another variant to this will be Moderately conservative investment if you more of risk taker in retirement age.

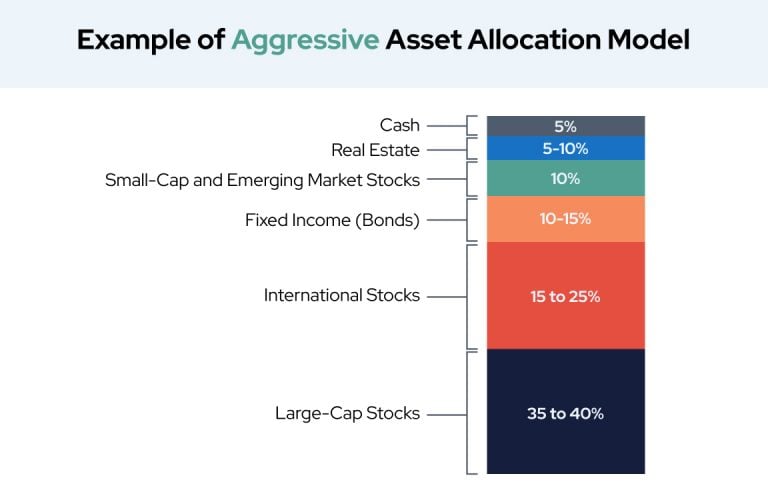

If you are young age 20-34 definitely aggressive or moderately aggressive investment is for you

This is the age were you can afford to take higher risk. Mostly investing into large-cap stocks from each sector. example , if you like tech stocks you can pick up big techs like apple , Microsoft .

if you like health care you can pick up Eli Lilly , J&J etc..

In Aggressive investment you can also held up bonds but in lower percentage.

If you think this is useful feel free to share it with your friends. Also Do follow us on twitter.

check out our chart section to find interesting charts for stock selection.