answer is Billions. Strong US Dollar causes corporate to lose billions in corporate earnings.

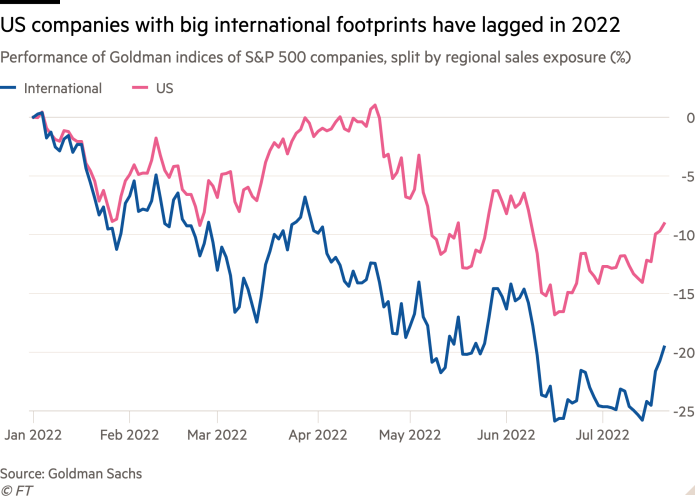

Many US corporations have lowered their guidance for the rest of the year as a result of the strong dollar wiping out billions of dollars from their second-quarter revenues.

After the US dollar climbed to its highest level in 20 years this month, the list of bellwethers suffering multi-million or billion-dollar losses has risen by the day and now includes IBM, Netflix, Johnson & Johnson, and Philip Morris. As titans of the technology sector like Apple and Microsoft, which do a large amount of their business outside of the US, disclose their quarterly results in the coming days, that group is anticipated to grow.

The strengthening of the dollar, according to a recent IBM warning, could cause a $3.5 billion drop in revenues this year, including around $900 million in the second quarter. Johnson & Johnson lowered its forecast after warning that this year’s sales could drop by $4 billion as a result of the sharp increase in the value of the dollar. The cost of the currency drag on the cigarette company Philip Morris exceeded $500 million in the quarter. According to streaming service Netflix, which features the thriller Stranger Things, the strong dollar cost them $339 million in sales between April and June.

They join a lengthy list of businesses, including Microsoft, Salesforce, and Medtronic, that had already brought up the subject before the dollar soared to parity with the euro.

Given the sector’s global reach, Big Tech is particularly vulnerable to currency fluctuations. Tech businesses in the S&P generated 59% of their revenues outside of the US. That is far more than the typical US large-cap publicly traded company; the S&P 500 groups collectively generated 29% of their $14 trillion in revenue outside the US in 2021.

A strong dollar may be mentioned for several quarters to come even if the dollar’s appreciation slows down since the effects of the dollar on earnings frequently lag the actual change in the currency. Given that many investors are anticipating that the Fed will have to moderate its aggressive pace of rate rises as the US economy cools, Karl Schamotta, chief market analyst at Corpay, anticipates the dollar to peak soon.

Do also checkout our chart section.

Follow us on twitter.